What We Finance

Insurance

Calculators

What We Finance

Insurance

Calculators

Service & Availability

Are you ready for a flexible, affordable, convenient vacation where the only limitation to where you can go is the road? Is finance the only thing stopping you from owning your own caravan? Then let our caravan finance specialists at Rostron Finance show you the options that will best suit your new awaiting lifestyle.

At Rostron Finance we strive to find the best caravan loan package on the market for your current financial and living situation. We are able to do this by negotiating your application with our wide range of banks and caravan finance lenders. This allows us to get you a highly competitive package and structure that will work best for you. We pride ourselves on a quick turn around time as we understand you want to get your new caravan on the open road and start the adventure as soon as possible.

As everyone’s circumstances are different, it’s best to discuss your financing plans with us in person. We have a wide range of facilities, so we are sure to have a product that will suit your needs.

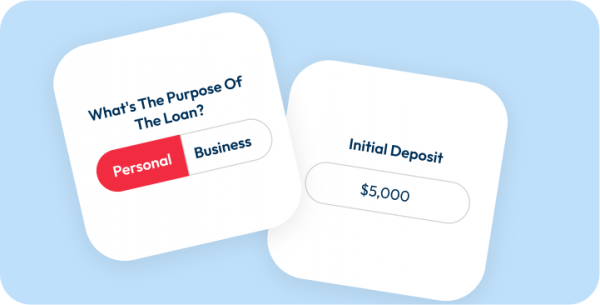

Every bank and lender offers different deals and products. We tailor your requirements (consumer/business, repayment, term, residual) to the loan that will work best for you.

When you let Rostron Finance do the hard work for you, you get access to the most competitive rates in the market. Whether you purchase your caravan new or used, through a dealership, private sale, or auction, we’re here to assist you.

At Rostron Finance, we understand that travelling by caravan doesn't always go according to plan, so we offer a range of products to protect your vehicle and yourself in case something does come up. The types of cover available with our caravan finance plans are:

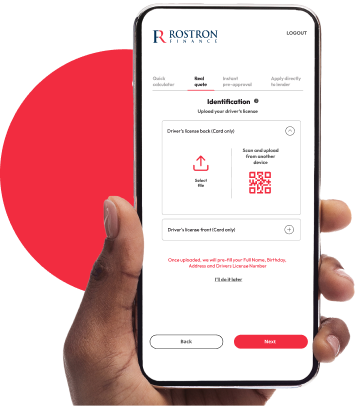

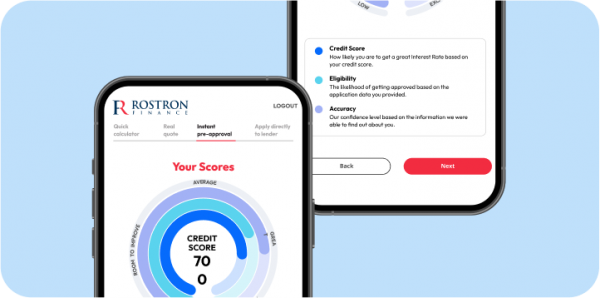

Instant Finance Pre-Approval with no impact on your credit score.

Quick Calculator

Instantly calculate your loan options with our smart online calculator

Real Quote

Instant Finance Pre-Approval with no impact on your credit score.

Instant Preapproval

Our powerful lender matching engine will match you with suitable lenders.

Apply to Lender

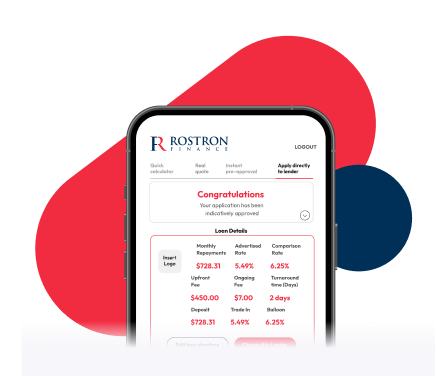

The fastest ever finance experience! Rostron’s Quick Apply supports direct-to-lender submissions

As an online finance provider, we won’t need hard copies of documents. The documentation we do ask for includes:

Any New Zealand resident or visa holder above the age of 18 who has a regular income and the required documents can apply for caravan finance.

It’s kinda hard not to love us

“Rostron helped throughout the whole process of financing my car and also helped with insurance.”

Hannah Clare

“I had the confidence I was getting the best deal. Rostron provided a really simple & smooth process”

Ryan Lee, Kerdic Homes Pty Ltd

Caravan finance is available for business and personal use. Explore our Equipment Finance options for more vehicle financing options your business may need.

We provide loans for caravans, RVs, and camper trailers. If you have a specific vehicle or type of caravan in mind, get in touch today to see if your ideal caravan is available.

Caravan finance approvals can be processed the same day or up to a few days later. Loan approval time depends on the level of information provided to us as part of the application, the loan’s complexity, and the application’s strength. The Rostron Finance broker assigned to your loan will keep you informed throughout the process so that you know how it is progressing and what any next steps may be.

The deal can be settled after the loan is approved and the original finance documents are signed. The supplier can expect the lender to send through the money within 24 hours, concluding the loan process.

There is a different minimum or maximum amount for each lender. Some lenders may require a loan of $1,500, others at $5,000. The maximum amount is also dependent on your own financial situation.

The loan structure and package chosen will determine any fees. Where applicable, you have the option to incorporate them into the loan itself or pay them at the start.

Fees do not apply if your NZ caravan finance application is declined or you decide not to proceed.

Brokers you can depend on to get it right

In need of a loan fast? Give us a call to get started.