5/5 Rating | 364+ Reviews

What We Finance

Insurance

Calculators

Are you looking to pursue your dreams, whether it's renovating your home, taking that dream vacation, or consolidating your debts?

Personal loans can be the key to turning your aspirations into reality. With flexible terms and repayment options tailored to your needs, you can secure the funds you require without the need for collateral.

Whether you have a specific goal in mind or need some extra financial flexibility, our personal loan brokers can provide a versatile solution to help you achieve your objectives. Start your journey towards financial empowerment today.

Personal loans offer a versatile solution for various financial needs. These unsecured loans don't require collateral, making them accessible for emergencies, investments, or other expenses.

What makes personal loans stand out is their flexibility. Lenders provide a range of terms and interest rates, allowing you to tailor the loan to your budget and timeline. You can opt for short-term loans for immediate needs or long-term loans for larger expenses. The application process is typically straightforward and swift, ensuring quick access to funds.

Personal loans also offer a chance to improve your credit history. Timely payments can boost your credit score, opening doors to better financial opportunities. With personal loans, you have the freedom to allocate funds where they're needed, whether for debt consolidation, medical bills, or home improvements. Explore the world of personal loans to achieve your financial goals with ease.

Instant Finance Pre-Approval with no impact on your credit score.

Quick Calculator

Instantly calculate your loan options with our smart online calculator

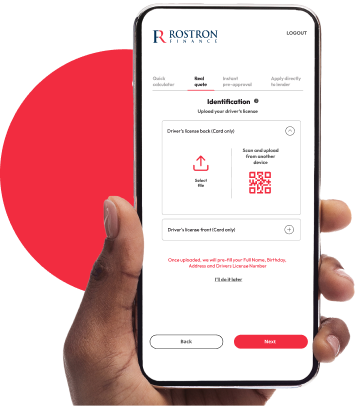

Real Quote

Instant Finance Pre-Approval with no impact on your credit score.

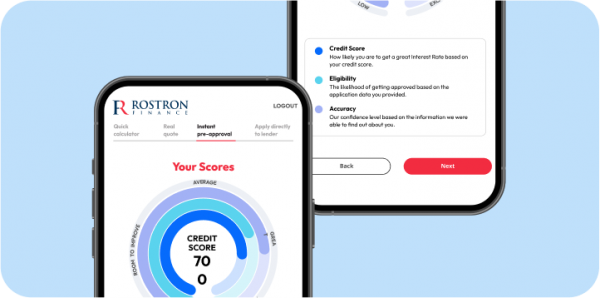

Instant Preapproval

Our powerful lender matching engine will match you with suitable lenders.

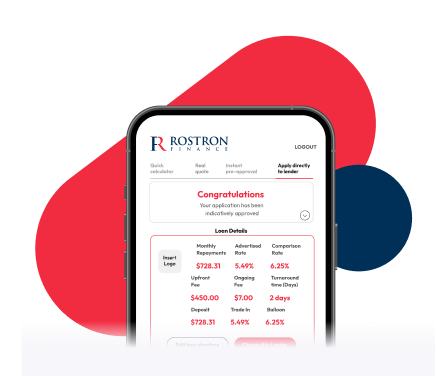

Apply to Lender

The fastest ever finance experience! Rostron’s Quick Apply supports direct-to-lender submissions

As an online finance provider, we won’t need hard copies of documents. The documentation we do ask for includes:

Any New Zealand resident or visa holder above the age of 18 who has a regular income and the required documents can apply for personal loans with Rostron Finance.

It’s kinda hard not to love us

“Rostron helped throughout the whole process of financing my car and also helped with insurance.”

Hannah Clare

“I had the confidence I was getting the best deal. Rostron provided a really simple & smooth process”

Ryan Lee, Kerdic Homes Pty Ltd

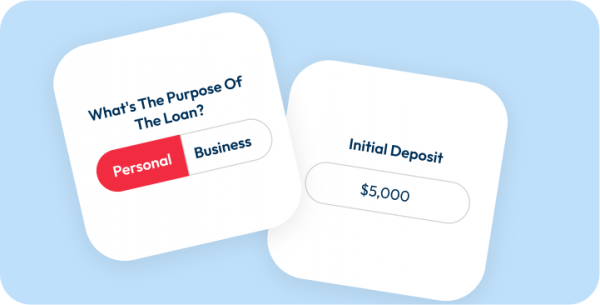

Business finance is available to individuals and companies when the goods are used predominantly for business contexts, i.e. more than 50%.

Personal finance through a secured or unsecured loan is available if the good will be used less than 50% of the time for business.

Contact one of our Rostron Finance specialists to find out which option is best for you, or apply now to get the best deal in the market today.

Brokers you can depend on to get it right

In need of a loan fast? Give us a call to get started.